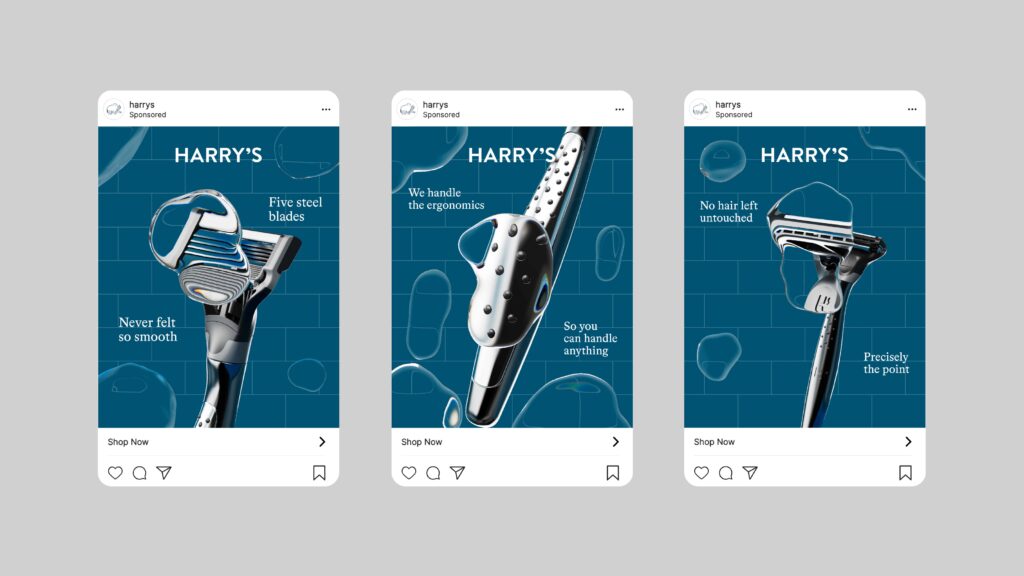

The $18 billion men’s grooming industry in the U.S. was once defined by aggressive product innovation, blade counts, and celebrity endorsements. Gillette, a P&G brand, ruled the market with more blades and higher prices. Then came Harry’s in 2013, co-founded by Andy Katz-Mayfield and Jeff Raider (also a co-founder of Warby Parker), and it changed the game by asking a simple question: What if shaving wasn’t about razors at all?

What followed was a brand journey rooted in empathy, subscription convenience, purposeful branding, and direct-to-consumer (DTC) excellence — a masterclass in modern marketing strategy.

The Problem – Razor Fatigue

In 2012, men were overwhelmed. Gillette had released a Fusion ProGlide Power Razor with five blades, a lubricating strip, and a microcomb. But the pricing model felt exploitative — cartridges sold at high markups behind plastic vaults in stores.

Also Read : Rebranding Failures: Lessons from Major US Brands

Harry’s marketing case study begins with a pain point — not just physical, but psychological. A 2013 Mintel study found 41% of men felt razors were overpriced, and 34% said they dreaded buying them in-store. The category had alienated its core audience.

Harry’s saw an opportunity: humanize grooming again. Give men affordable razors, shipped to their doors, and build a brand that spoke like a friend, not a salesman.

Continue reading…

Coming up next: The brand playbook Harry’s used to go from a $0 startup to a $1.37B Unilever breakup in just six years.